- Empowering underwriters with dynamic tools

- Better loan closures with auto-verifications, dynamic tasks, and smart notifications

- Efficient operations with configurable workflows, training integration, and notifications

- Real-time performance monitoring to enrich borrower data for marketing transitions

- Manage multiple loans for a borrower

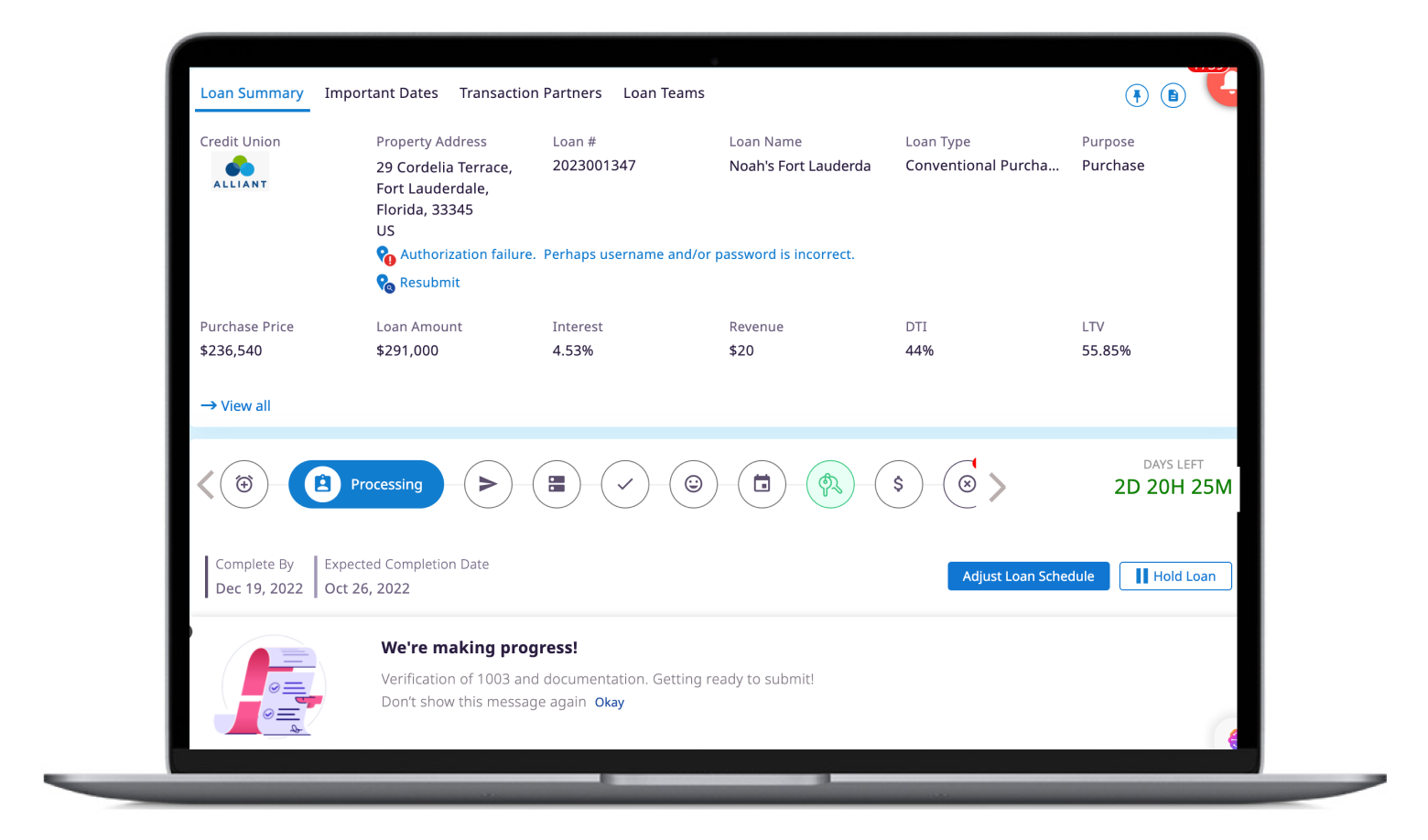

Manage, View, Collaborate, and Celebrate – All in One Place.

Ditch file-by-file loan origination for efficiency, responsiveness, and adaptability through instant, interactive insight.

- AI-powered portfolio visibility into loan insights and milestone monitoring

- Visual Loan Health Tracking

- Manage multiple loans for a borrower, fostering repeat business opportunities.

- Access all loan details in one place for streamlined management.

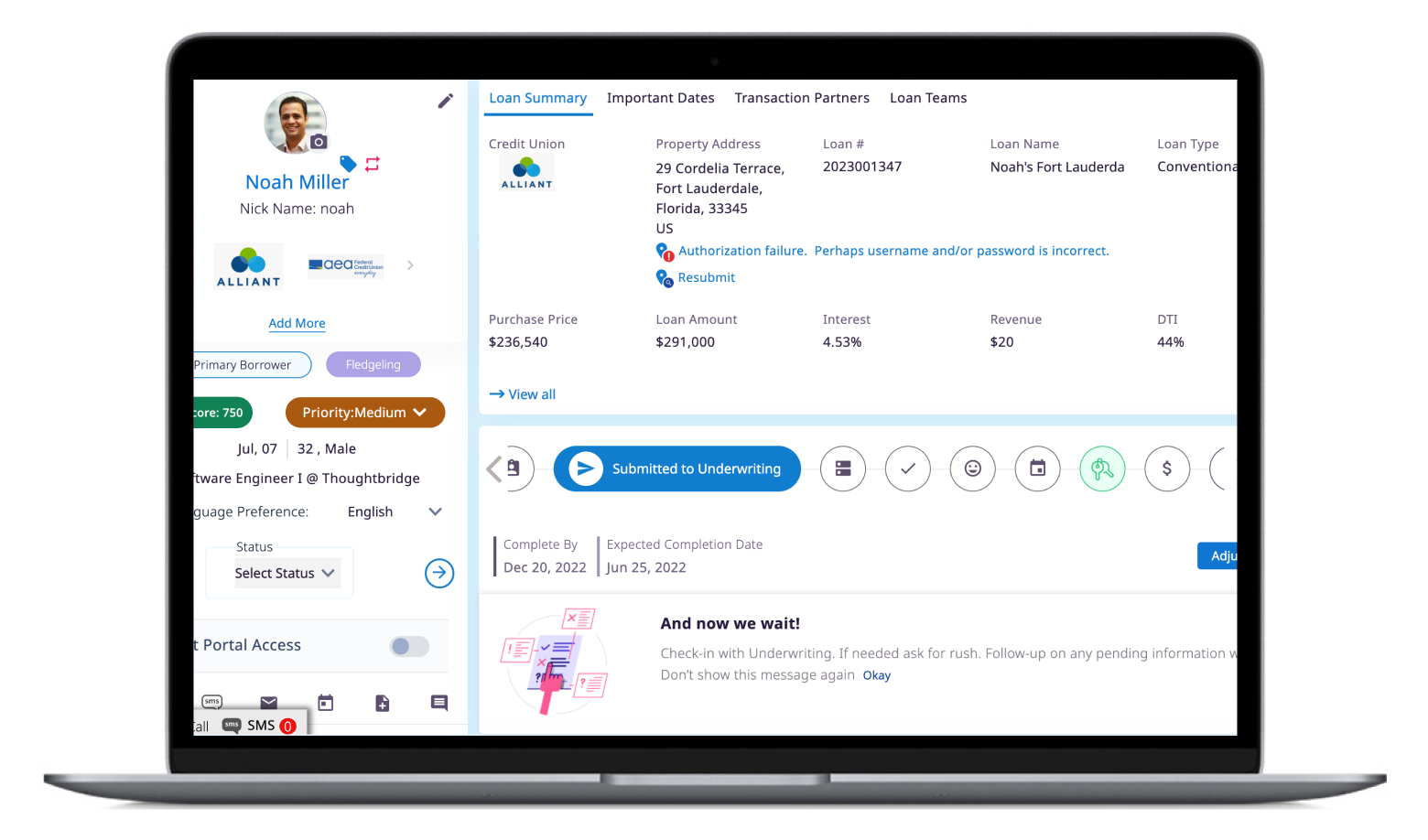

Inexpensive Loan Processing.

Optimized workflow automation framework for maximum loan processing efficiency.

- Streamline loans with automation, user-friendly interfaces, and collaboration.

- Customized workflows and checklists

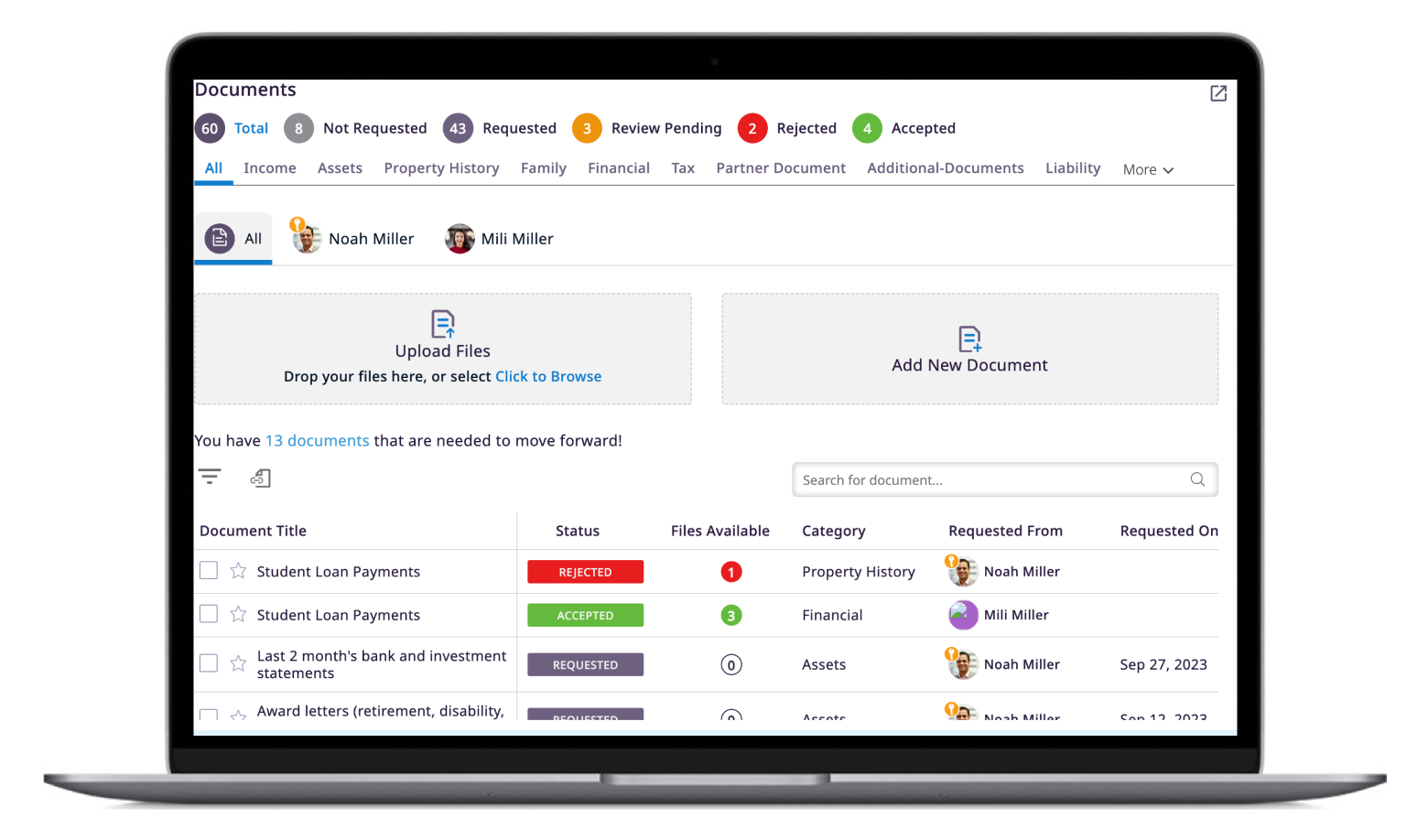

- Centralize application lifecycle and documents for seamless management.

- Receive the best next step recommendations automatically.

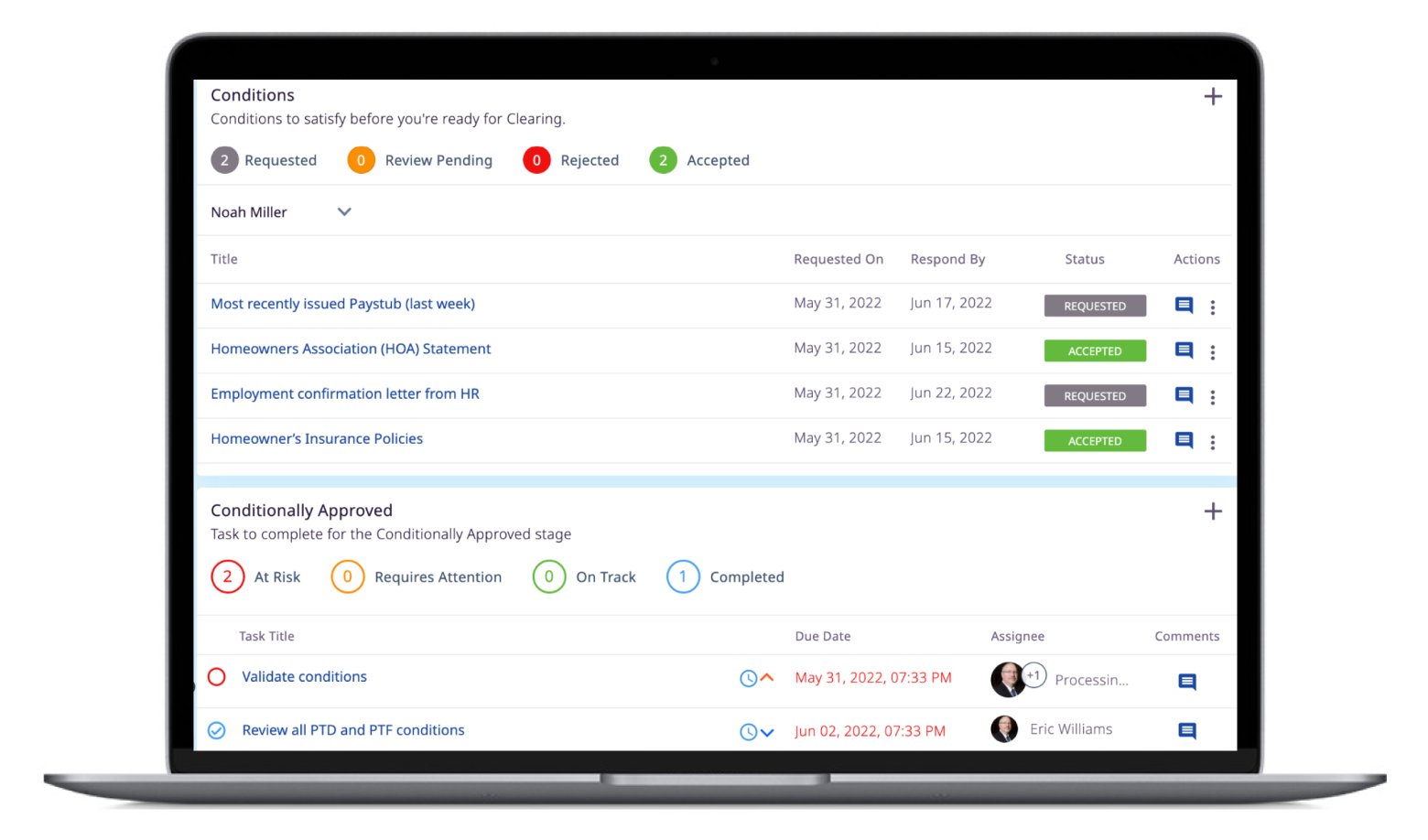

Seamless Integration, Dynamic Tasks, Automated Conditions.

A powerful toolkit to streamline your lending operations that empowers your team and boosts efficiency.

- Achieve bi-directional data integration with Encompass for efficiency and hyper-automation.

- Tailor tasks to loan journeys, milestones, teams, or programes for efficiency.

- Seamlessly integrate conditions with Encompass.

- Efficiently track and reduce manual work

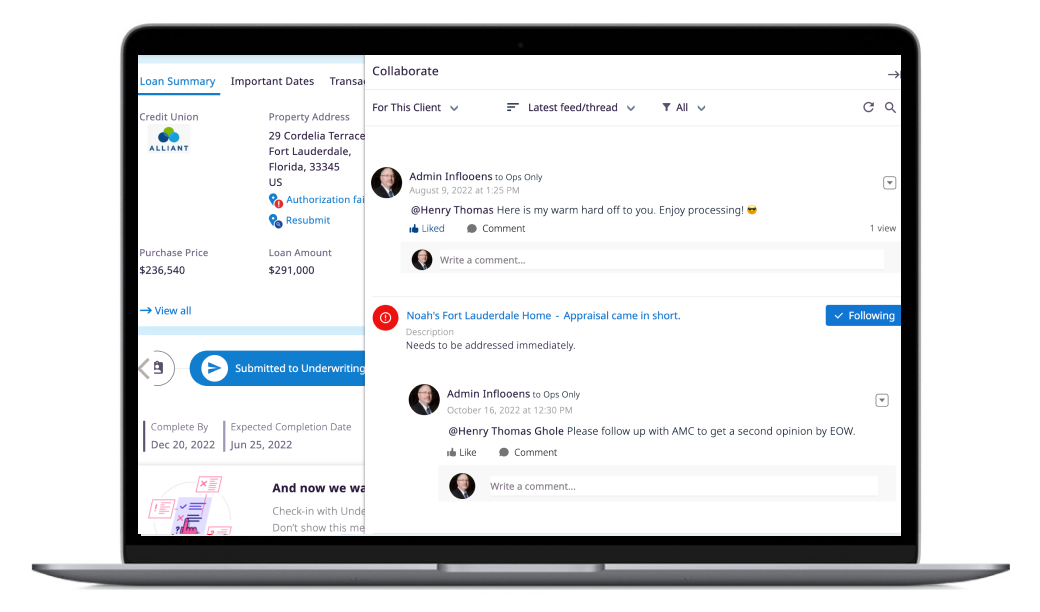

Client Centric Processing.

Put borrowers at the heart of your lending experience with transformative features for communication and documentation.

- Omni-Channel Communications and Audit Trail Transparency

- Elevate borrower experience

- Integrated email templates

- Uniform communication

throughout the loan journey

Improved Scalability and Visibility.

A unified user interface for Mortgage Loan Officers (MLOs) and processors, promoting consistency and efficiency.

- Customize tasks for smoother loan journeys, milestones, workflows, or teams.

- AI-driven tracking and alerts for issue resolution

- Simplify loan-related document handling

- 40% reduction in cycle times and a 50% increase in productivity