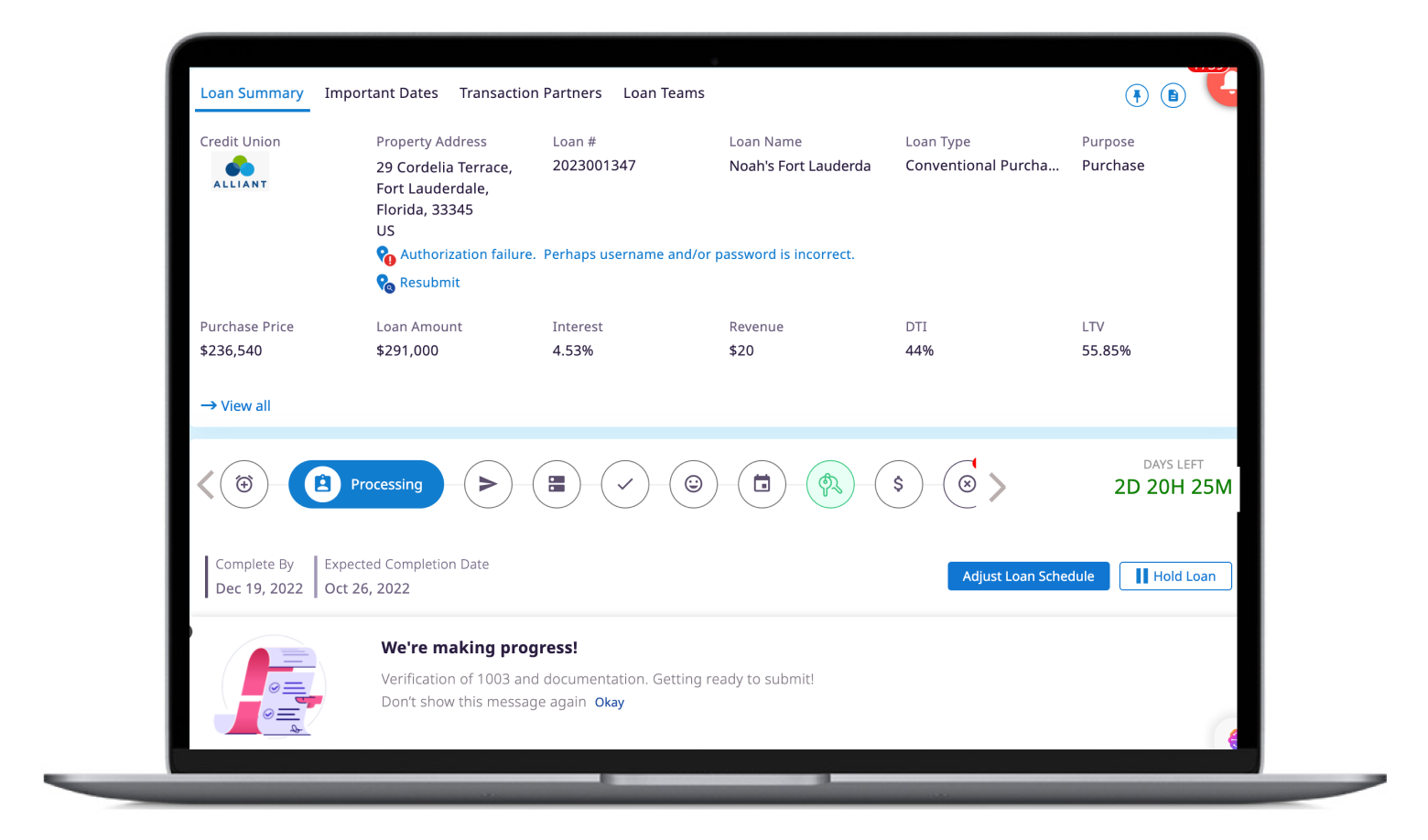

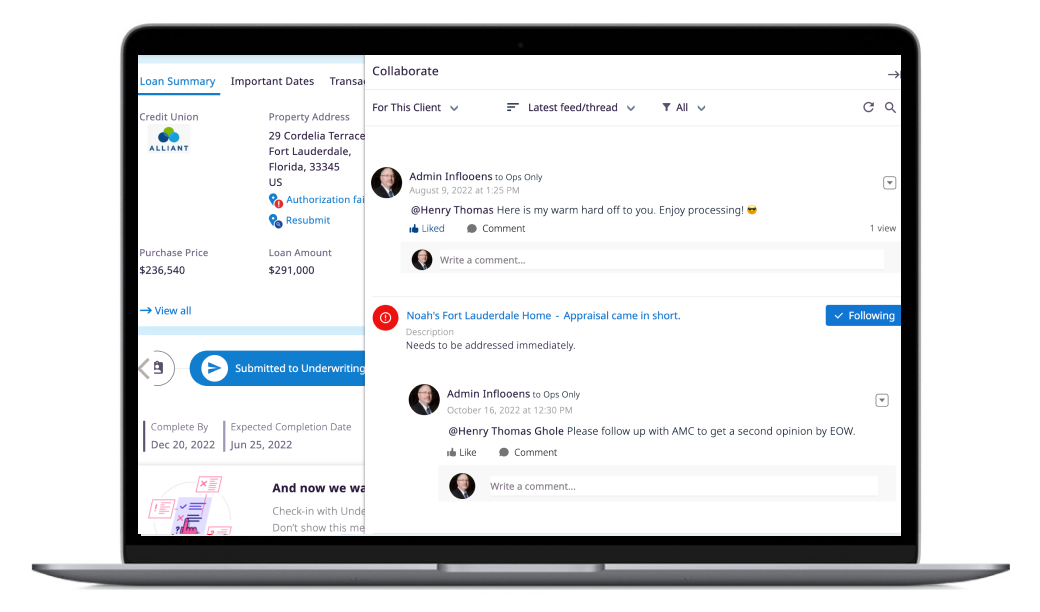

Manage, View, Collaborate, and Celebrate – All in One Place.

Ditch file-by-file loan origination for efficiency, responsiveness, and adaptability through instant, interactive insight.

Inexpensive Loan Processing.

Optimized workflow automation framework for maximum loan processing efficiency.

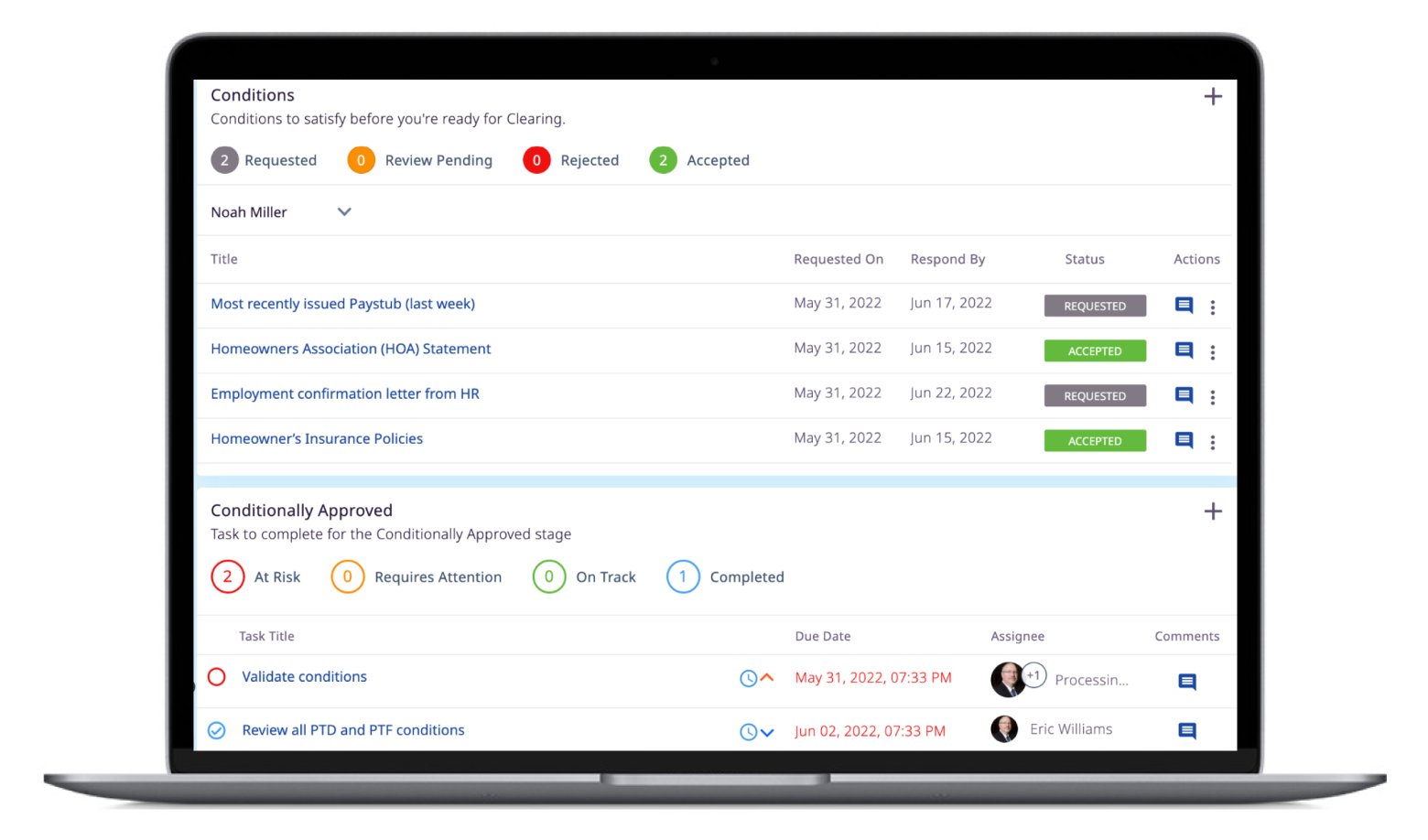

Seamless Integration, Dynamic Tasks, Automated Conditions.

A powerful toolkit to streamline your lending operations that empowers your team and boosts efficiency.

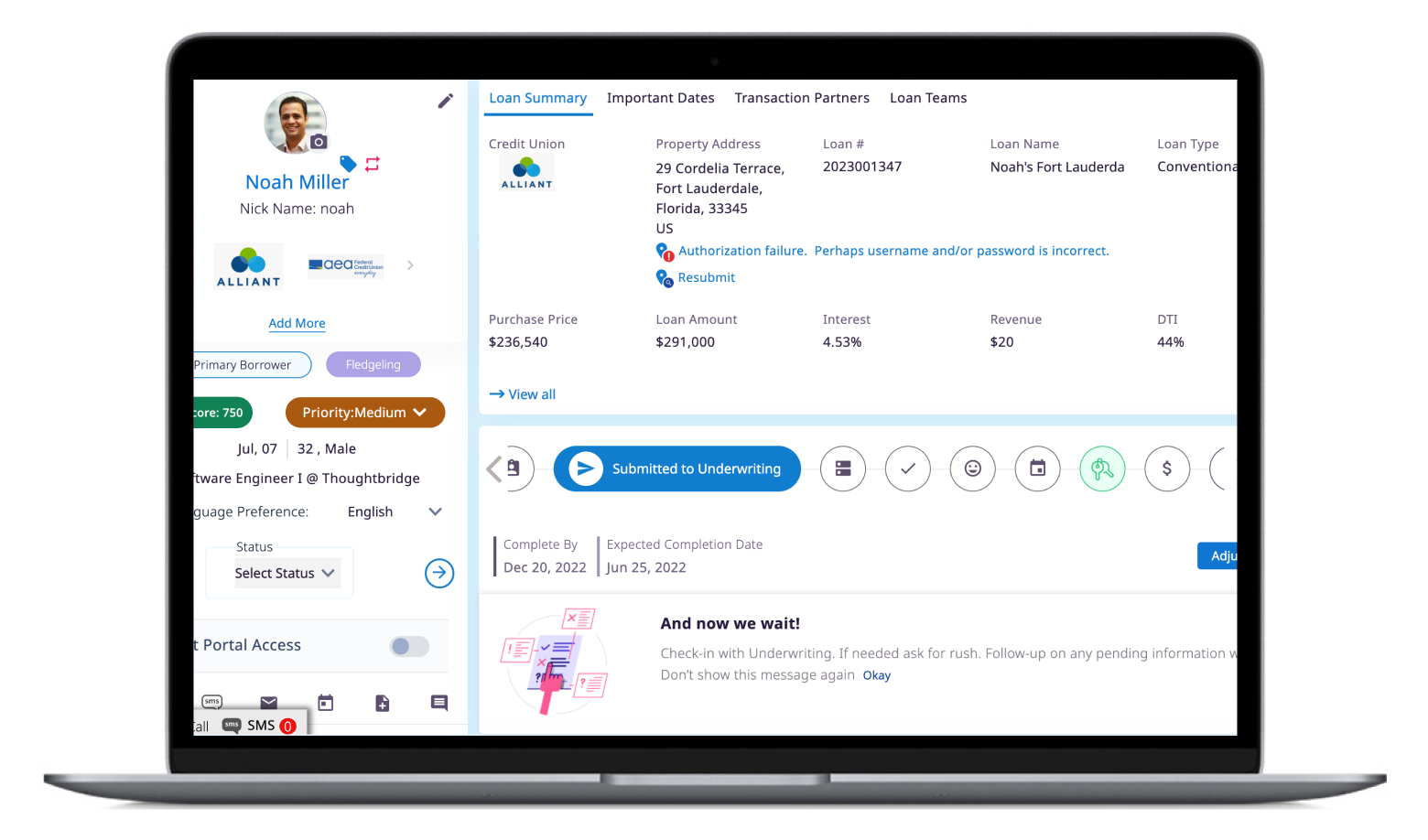

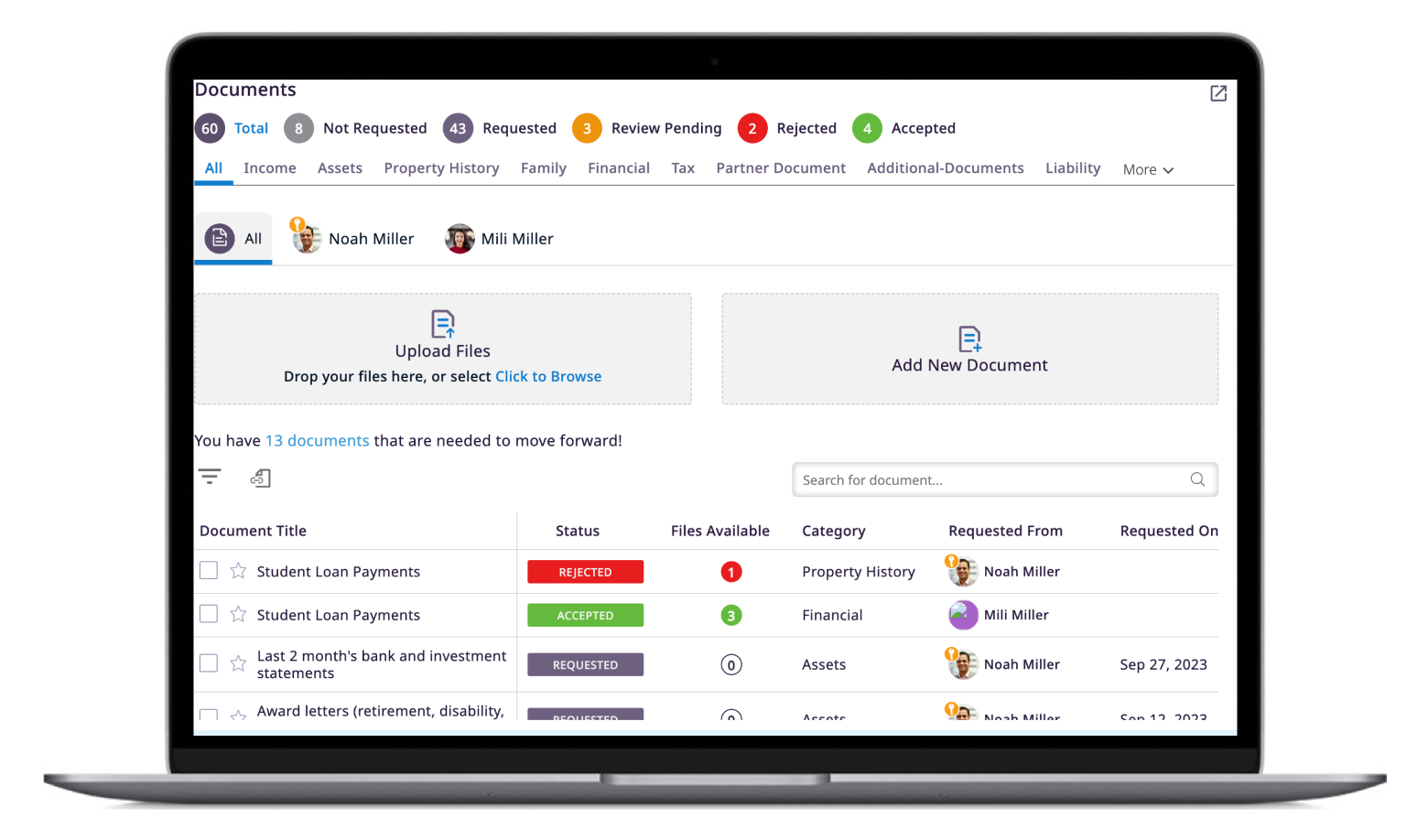

Client Centric Processing.

Put borrowers at the heart of your lending experience with transformative features for communication and documentation.

Improved Scalability and Visibility.

A unified user interface for Mortgage Loan Officers (MLOs) and processors, promoting consistency and efficiency.